Enhance Your Portfolio With Control

Building a resilient, high-performance portfolio requires strategic investments that balance stability with growth. First mortgage loans provide a controlled, low-volatility alternative to stocks and bonds, helping to fortify your portfolio while increasing yield potential.

Our exclusive deals, sourced from a trusted network of originators, undergo rigorous due diligence and underwriting. We identify high-quality opportunities, so you can enjoy reliable returns with confidence and control.

Investing with control

A key element in building a successful investment portfolio involves the inclusion of investing in high yielding first mortgage loans. Unlike stock and bonds, investing in first mortgage loans is designed to reduce volatility and risk, while enhancing your returns.

Capital Preservation

Conservatively levered first mortgage loans secured by real property to protect capital.

High Yielding Returns

First mortgage loans offering stable high-yielding returns of between 8% to 11%

p.a paid monthly.

Personalised Investing

Select from a range of curated and vetted deals based on your investment preferences.

Ctrl Capital supports a mix of investors

Wholesale investors

Attractive risk-adjusted returns uncorrelated to public markets.

Family offices

Managed solutions in private real estate debt for family offices worldwide.

SMSF investors

Regular returns for SMSF investors and retirees.

What makes Ctrl Capital unique?

Co-investment

We maintain a material stake in each and every investment through to maturity with our co-investors.

Unparalleled experience

Ctrl Capital consists of highly qualified career professionals who have successfully managed some of the largest credit portfolios in Australia.

42 %

Average LVR across all deals

$250m+

Capital Deployed

9.68 %

Average IRR (Net of Fees)

100 %

Investor Capital and Interest Preservation

Our performance speaks for itself

We’ve helped our exclusive group of investors access compelling high-yielding, low-risk deals, with no investor capital or interest lost.

Each deal is built by our professional investment team who have a vested interest which is 100% aligned with our investors through to maturity.

Sample deals

Mobil Petrol Station

Gillenbah, NSW

6 Months

$3.25M

Loan Amount

45%

LVR

Residential Land Bank

Thurgoona, NSW

12 Months

$2.10M

Loan Amount

40%

LVR

Commercial Land Bank

Sunshine Coast, QLD

9 Months

$5.20M

Loan Amount

21%

LVR

Commercial Retail

Port Kembla, NSW

12 Months

$1.40M

Loan Amount

55%

LVR

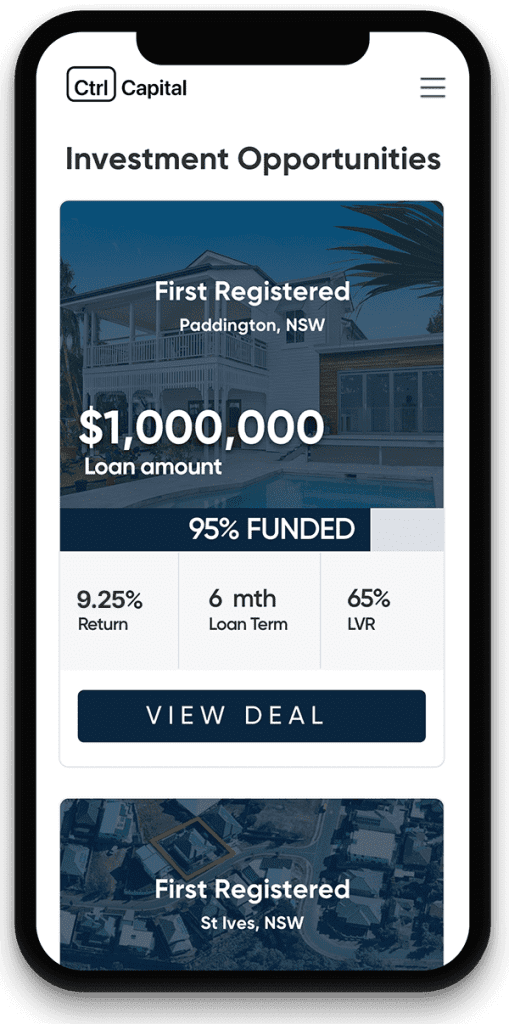

There are two ways to invest with us:

Ctrl Direct Access Fund and Deal-by-Deal.

Ctrl Direct Access Fund

Invest in our flagship fund, a highly diversified portfolio of First Mortgages secured against residential, commercial, industrial and land real-estate.

Minimum investment size:

$50,000

Deal-By-Deal

For investors who would rather select to invest on individual deals, our platform allows you to browse opportunities that suit your appetite. Subscription for each deal is allocated on a first-come, first-served basis.

Minimum investment size:

$100,000

How to invest with Ctrl Capital

1

You select

Unique investments in stand-alone mortgages or managed fund.

2

Retain control

Yields, established timeframes, and risks that align with your goals.

3

We do the hard work

Managing assets so you don’t have to.